Capital Plan Methodology

Under direction of the City Administrator, department staff annually assesses facility conditions, determines cost projections for renewal projects and proposed enhancements, and analyzes available funding resources to prepare a 10-year capital plan.

Through a series of meetings the Capital Planning Committee reviews proposals, staff recommendations, and documents toward the development of the Capital Plan. These reviews do not, and are not meant to, replace the authority of department commissions’ or other oversight bodies under the City Charter and other codes. Rather, the 10-year plan is meant to provide a forum that examines capital needs from a citywide perspective and to foster a dialogue on those needs between stakeholders, commissions, the Mayor, and the Board of Supervisors.

Staff uses two approaches to collect data for the Plan. The Facilities Renewal Resource Model (FRRM) is used to collect information on the state of repair for major facility and infrastructure subsystems (also known as renewals) for all of the General Fund departments. The Airport, Port, and MTA have implemented this model for their facilities as well. In addition, General Fund departments submit enhancement requests using the Capital Planning and Reporting system (CPRS). Each proposal is reviewed by professional staff (e.g., architects, engineers, analysts etc.) and categorized as a funded, deferred, or emerging need.

Facilities Renewal Resource Model (FRRM)

The City uses the facility life-cycle model to predict annual funding requirements for General Fund department facilities. The objectives of the facility modeling effort are listed below:

- Develop a budget model to predict relative annual funding requirements for facilities renewal and document the existing backlog of deferred maintenance in a consistent way for all departments.

- Provide a basis for a funding plan that will first address adequate resources for renewal and then a reduction of the deferred maintenance backlog.

- Create consistent and comparative data among departments for determining funding allocations and targets for addressing renewal as a part of operating or capital budgets.

- Deliver a cost model to each department with associated staff training so that facilities renewal and deferred maintenance needs can be updated annually and progress in meeting those needs can be measured.

- Provide a planning tool for departmental use which provides a useful life “systems” profile of each building as a way of predicting future funding needs or packaging projects to leverage fund sources.

- Develop a credible model to assess needs consistently and to focus on total funding needs and strategies.

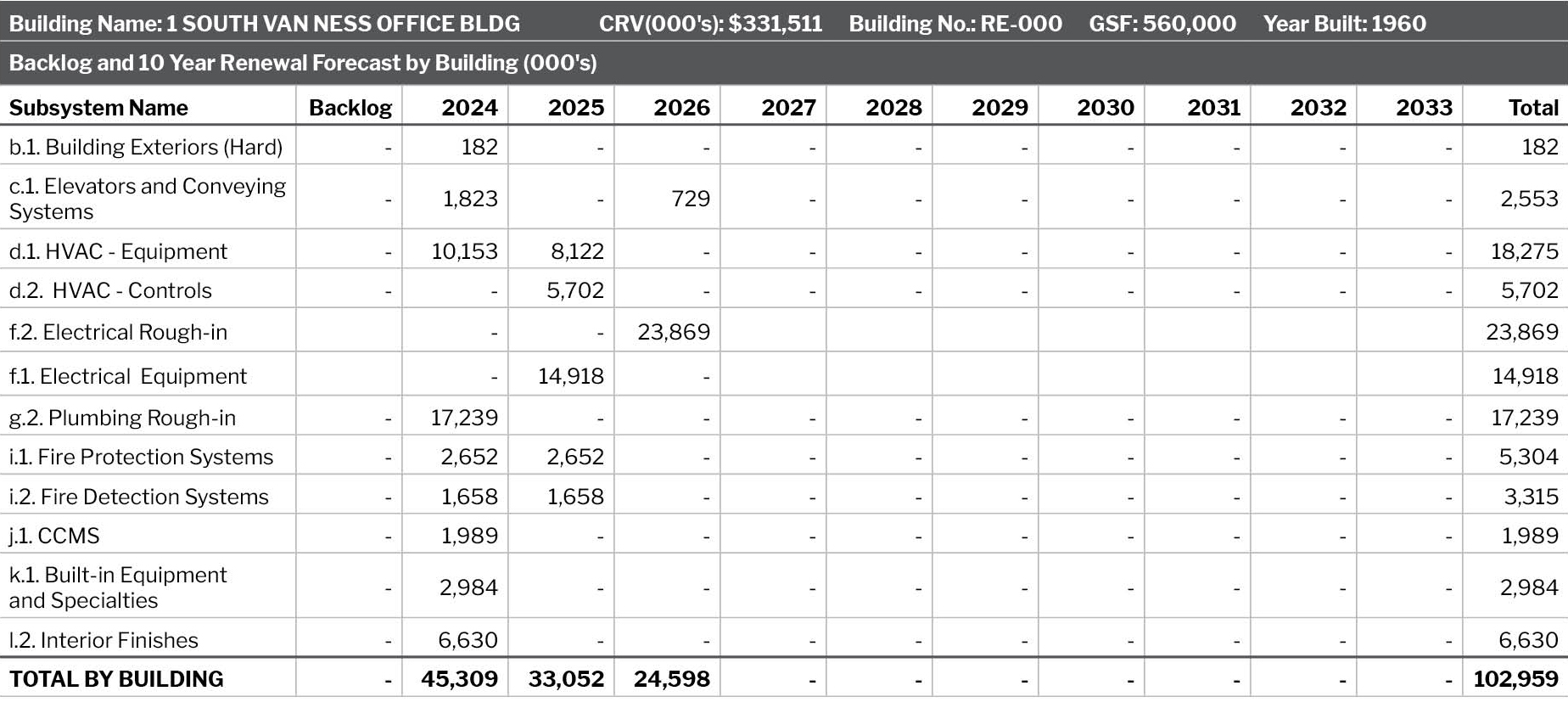

The model uses building information (gross square feet, construction date, facility subsystem type, etc.) and an approach based on subsystem life cycles and replacement costs to estimate the backlog of deferred maintenance and future capital reinvestment needs. Shown here is an example of the 10-year renewal forecast report generated by FRRM for a particular facility. This report, one of dozens available, shows subsystems within the building that need to be replaced during the next 10 years and the corresponding cost (in thousands). A variety of other reports are available for further analysis.

Each department maintains the model, with the capability of summarizing information at both the department and citywide level. The model has a great deal of built-in flexibility that allows the City to enter new data and even change the underlying assumptions in future years.

The FY 2024-33 Capital Plan reflects renewal data collected from August through December 2022 and includes detailed information for each General Fund department. These findings are summarized in the renewal graphs and the renewal line of the financial summary schedules for each of the General Fund service areas found throughout the Plan.

Capital Plan Assumptions

- The FY2024-33 Capital Plan uses the Annual Infrastructure Construction Cost Inflation Estimate (AICCIE) of 6% as the escalation rate for the first year, followed by 5% for the remainder of the Plan.

- Fiscal years (FY) in the Plan refer to the calendar year in which the City’s July 1 to June 30 budget cycle ends. For example, FY2024 refers to calendar year dates from July 1, 2023 to June 30, 2024. Dollars are listed in thousands for all financial schedules unless otherwise noted.

- For all planned General Obligation Bonds, the financial schedules show the total bond amount in the fiscal year during which the bond is to be approved by voters. For example, a G.O. Bond proposal on the November 2024 ballot will appear in FY2025 of the financial schedule.

- The General Obligation Bond Program assumes growth in Net Assessed Value of -0.24% in FY2024, 1.08% in FY2025, 0.99% in FY2026, 1.34% in FY2027, 1.79% in FY2028, and 3% annually thereafter.

- When issued, G.O. Bonds proposed by this Plan will not increase voters’ long-term property tax rates above FY2006 levels. In other words, new G.O. Bonds will only be used as funding source when existing approved and issued debt is retired and/or the property tax base grows.

- The General Fund Debt Program assumes that General Fund discretionary revenues grow 3.30% in FY2024, 3.65% in FY2025, 3.85% in FY2026, 2.33% in FY2027, 1.77% in FY2028, and 2.70% annually thereafter. In addition, the General Fund Debt Program assumes that the amount of General Fund revenues spent on debt service will not exceed 3.25%.

Jobs Creation Estimation Methodology

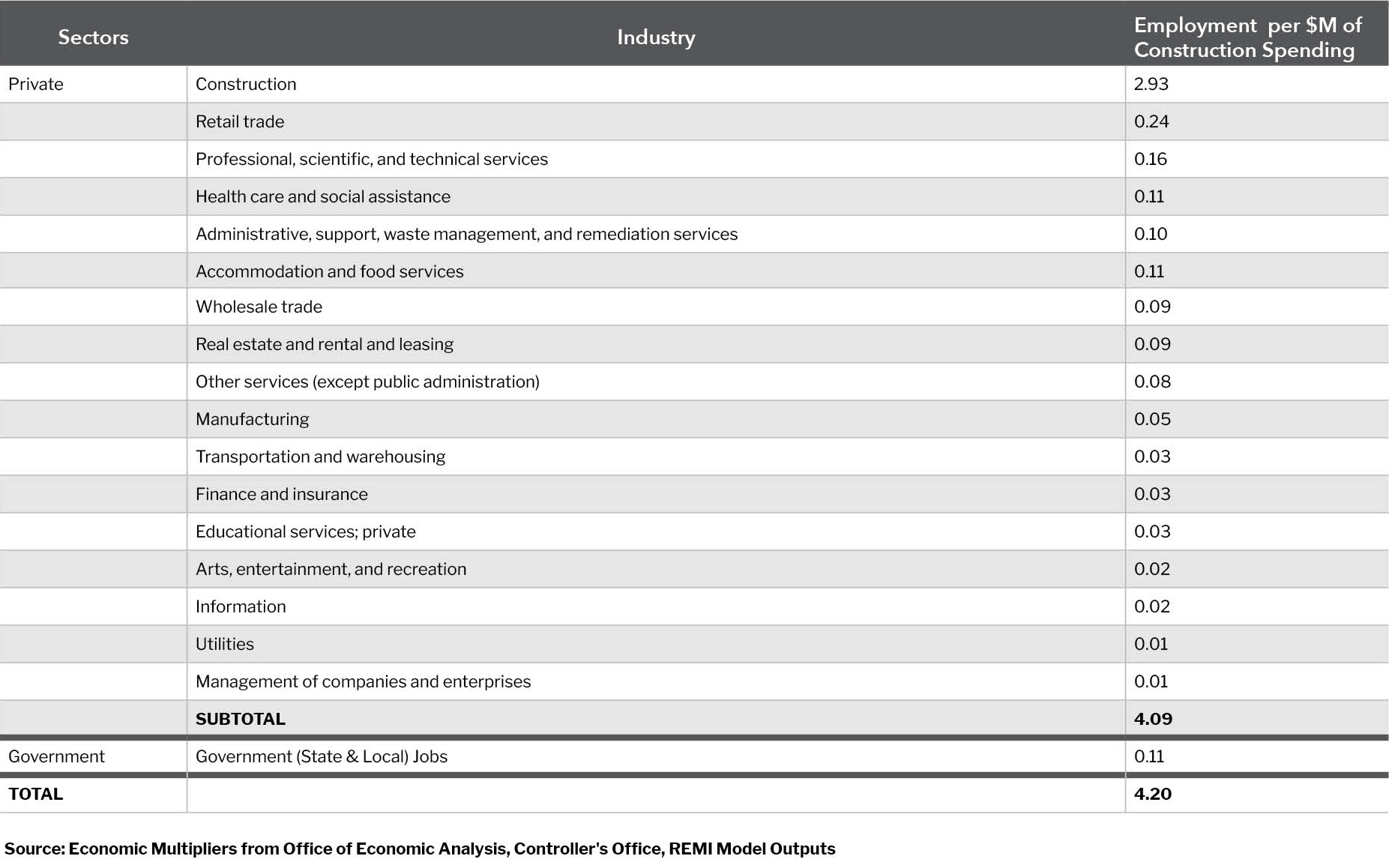

In an effort to better evaluate and prioritize capital projects, local governments are examining not only upfront financial costs but also their contributions of direct and indirect jobs generated by the capital investment. The City and County of San Francisco’s FY 2024-33 Capital Plan estimates over $41 billion in capital projects during the next ten years, which will create over 170,000 San Francisco jobs. A job is defined as one job year of full-time work. For example, five people employed for four years equals 20 job years. This jobs estimate is based on the REMI Policy Insight model which attributes 4.20 San Francisco jobs per million dollars in construction spending. This is exclusive of the additional jobs created outside of the City and County as workers and materials migrate in from surrounding areas.

Customized for San Francisco, REMI has the unique ability to determine the effects of taxes and other variables on the local economy. As a result, the Controller’s Office of Economic Analysis uses this model for analyzing the economic impact of pending legislation. The table below summarizes the number of job years from the REMI model based on $1 million of construction spending in San Francisco.

Infrastructure Finance Districts Criteria

These guidelines are intended to supplement the Board of Supervisor Guidelines for the Establishment and Use of Infrastructure Financing Districts in San Francisco (Board Guidelines), which were approved by the Board of Supervisors pursuant to Resolution No. 66-11, which was adopted by the Board of Supervisors on February 8, 2011, and signed by the Mayor on February 18, 2011.

The guidelines are organized into two sets of criteria: (1) “Minimum Threshold Criteria” that must be satisfied for future infrastructure financing districts (IFDs) to be formed by the Board of Supervisors (Board) and (2) “Strategic Criteria” that should be considered by the Board but are not preconditions to forming an IFD.

These guidelines do not apply to any existing redevelopment project area or to any property owned and/or managed by the Port of San Francisco.

Minimum Threshold Criteria:

Limit to areas that are (i) rezoned as part of an Area Plan or Development Agreement with extensive need for infrastructure and public facility improvements and for which IFD funding is necessary for the project to be financially feasible and (ii) adopted as a Priority Development Area (PDA). PDAs are officially-designated infill development opportunity areas. To be eligible for designation by the Association of Bay Area Governments, an area must be near existing or planned fixed transit or comparable bus service, and be zoned for increased housing densities. PDA designations inform regional agencies, like the Metropolitan Transportation Commission, which areas within a jurisdiction are willing to accept regional growth. Accordingly, Planned PDAs are eligible for additional capital infrastructure funds, planning grants, and technical assistance. Linking creation of future IFDs to PDA areas will allow the City to leverage IFD incremental property tax revenue to increase its chances of receiving matching regional, state or federal infrastructure or transportation grants.

Limit formation of IFDs to areas where rezoning is projected to result in a net fiscal benefit to the General Fund (GF) as determined by the Controller’s Office. To determine whether a rezoning will generate a net fiscal benefit, the Controller’s Office will calculate the GF revenue (less any GF costs) expected to result from the growth projected to occur within the IFD boundaries after rezoning. The Controller’s Office will then subtract the GF revenues (less any GF costs) expected to result from the projected growth that could have occurred within the IFD boundaries under the existing uses. If the result within the IFD boundary is greater than zero, there is a net fiscal benefit from the rezoning. Based on this formula, future IFDs will likely be limited to areas that receive or have received substantial and quantifiable upzoning in the form of (1) net increases in height, bulk, and density that result in greater developable FAR than prior “baseline” zoning, (2) changes in permitted land uses that increase property values, or (3) permit streamlining that increases the certainty and speed of entitlements.

Restrict the maximum incremental property tax revenue that is allocated to an IFD to no more than 50% of the annual incremental property tax revenue over the term of the IFD, and require that each district have a projected positive GF net fiscal benefit over its term after subtracting the incremental property tax revenue allocated to the IFD. The maximum incremental property tax revenue that may be allocated to the IFD is 50% of the total incremental property tax revenue, however the City may allocate all or a portion of the remaining 50% of the annual incremental property tax revenue on a conditional basis to provide debt service coverage for the IFD’s bonds or other debt. The intent of the 50% limit is that each project provides net new property tax revenue to the GF even after the allocation of incremental property tax revenue to the IFD.

Limit to projects that address infrastructure deficiencies in the general area of the IFD. Because the City has not developed universally-applied and objective citywide standards for assessing the sufficiency (or deficiency) of neighborhood-serving infrastructure, Board-adopted planning documents (like Area Plans) that qualitatively and/or quantitatively describe such deficiencies will suffice until new citywide standards are adopted at a later date. After the adoption by the Board of Supervisors of a revision to the Board Guidelines, the Capital Planning Committee, in coordination with the Planning Department and the Area Plan Infrastructure Finance Committee, should develop and recommend Board approval of standards for assessing neighborhood infrastructure deficiencies in the following areas: (i) parks & open space improvements; (ii) “Better Streets” streetscape & pedestrian safety improvements; (iii) bicycle network improvements; (iv) transit-supportive improvements; and (v) publicly-owned community center and/or child-care facilities. These standards would prevent the use of IFD funds for public facilities that far exceed citywide norms for cost and quality. In areas with previously approved Area Plans that included public infrastructure commitments, these new criteria would be applied to help prioritize spending in direct collaboration with any existing Community Advisory Committees (CACs) or residents’ associations.

Limit use of IFD monies to individual infrastructure projects with a long-term maintenance commitment. Once an IFD is established, limit appropriations to infrastructure projects that have an identified source of funding for ongoing maintenance and operations. This commitment could be in the form of a General Fund appropriation or through public-private financing mechanisms, such as a Master HOA or a Community Benefit District agreeing to maintain a public park, or through formation of a supplemental property tax assessment district, like a Mello-Roos Community Facilities District or a Special Tax District.

Require that all incremental property tax revenue generated within future IFDs flows directly to the General Fund unless and until specifically appropriated by the Board for deposit into the Special Fund of the IFD or pledged (i) for debt service/coverage on bonds or other debt of the IFD or (ii) other contractual obligations approved by the Board.

Limit IFD debt (as defined in the IFD laws) across all IFDs such that total annual debt payments do not exceed 5% of annual property tax revenue1. This ensures that the share of property tax revenues going to service IFD debt never grows so high that it limits the City’s budgetary flexibility. Gradually reinvesting up to 5% of this source in the City’s local economy and growing the tax base will not significantly limit the ability of policymakers to allocate the remainder of the revenue. This control applies to property owned and/or managed by the Port of San Francisco or managed by the Treasure Island Development Authority, including already-established IFDs under each departments’ jurisdiction. This control does not apply to any existing Redevelopment Area. In no case will this guideline impair the responsibilities of established IFDs, whether established before or after the date of the Board Policy and this Interpretative Supplement.

Include an option to terminate the ongoing allocation of incremental property tax revenue to IFDs that were formed but the benefited development did not meet minimum performance standards. In the formation documents or IFP of each IFD, the City shall include provisions providing for the termination of its allocation of incremental property tax revenue in future fiscal years or the dissolving of the IFD should the project benefited by the IFD not achieve minimum development milestones. These milestones may be amended or expanded on at the formation of each IFD, but the baseline milestone shall be achieving a final Certificate of Occupancy for the first tax increment-producing building within ten years of the formation of the IFD. The intention of this criteria is to ensure if that if the City has established an IFD to provide assistance to a project, but the project has not made progress with development, the limited capacity under the City’s 5% limit (Criteria #7, above) can be reallocated to another project better able to leverage the assistance of the IFD to achieve the City’s goals. In preserving this option, however, the City acknowledges that the formation documents or IFP of each IFD that contains such an option shall clearly state that the City’s option shall be of no force or effect as long as any bonds or debt of the EIFD is outstanding.

Strategic Criteria:

In general, if using an IRFD, limit the district to parcels without any occupied residential use. The City may want to exclude parcels that contain existing occupied residential structures when forming a new IRFD because IRFD law requires an actual voter-based election if there are 12 or more registered voters within the proposed boundaries of the IRFD. If there are fewer than 12 registered voters, the law only requires a weighted vote of the property owners, which, in general, should reduce the complexity and time required for forming a district. On the other hand, there may be circumstances where a voter-based election may be both desirable and manageable.

Use IFDs strategically to leverage non-City resources. As noted in Threshold Criteria #1 above, IFDs should be used as a tool to leverage additional regional, state and federal funds, thereby serving a purpose beyond earmarking General Fund resources for needed infrastructure. For example, IFDs may prove instrumental in securing matching federal or state dollars for transportation projects.

For future IFDs in newly rezoned areas, require that “best-practices” citizen participation procedures be put in place to help City agencies prioritize implementation of IFD-funded public facilities. This could be achieved through establishing CACs or other official public stakeholder groups.

Develop an annual evaluation process, with specific quantitative and qualitative criteria for monitoring the performance of IFDs and the benefits received by the City and its residents and businesses.

The Board of Supervisors may, in its sole discretion, approve IFDs that deviate from the Board Guidelines and this Interpretative Supplement. The failure of the City to comply with any provision of the Board Guidelines or this Interpretative Supplement shall not affect the authorization, validity or enforceability of any IFD, including the City’s allocation of incremental tax revenues to the IFD, or any bonds or other debt of an IFD.

* Annual property tax revenue, for the purpose of this guideline, will include the City’s general fund, including amounts that subsequently would be set aside in certain special funds in accordance with the City’s Charter, and MVILF revenues.