Debt Program

General Obligation Bonds

The Plan anticipates $1.2 billion in General Obligation (G.O.) Bonds over the next 10 years. G.O. Bonds are backed by the City’s property tax revenue and are repaid directly out of property taxes through a fund held by the Treasurer’s Office. As a result of the successful passage of several bonds in the past few years, the capacity of the G.O. Bond Program is $1.5 billion (or 54 percent) lower than the previous 10-Year Capital Plan. This means the Plan is recommending fewer and smaller bonds than in previous years.

Table 1.5 shows the Capital Plan’s G.O. Bond Program for the next 10 years.

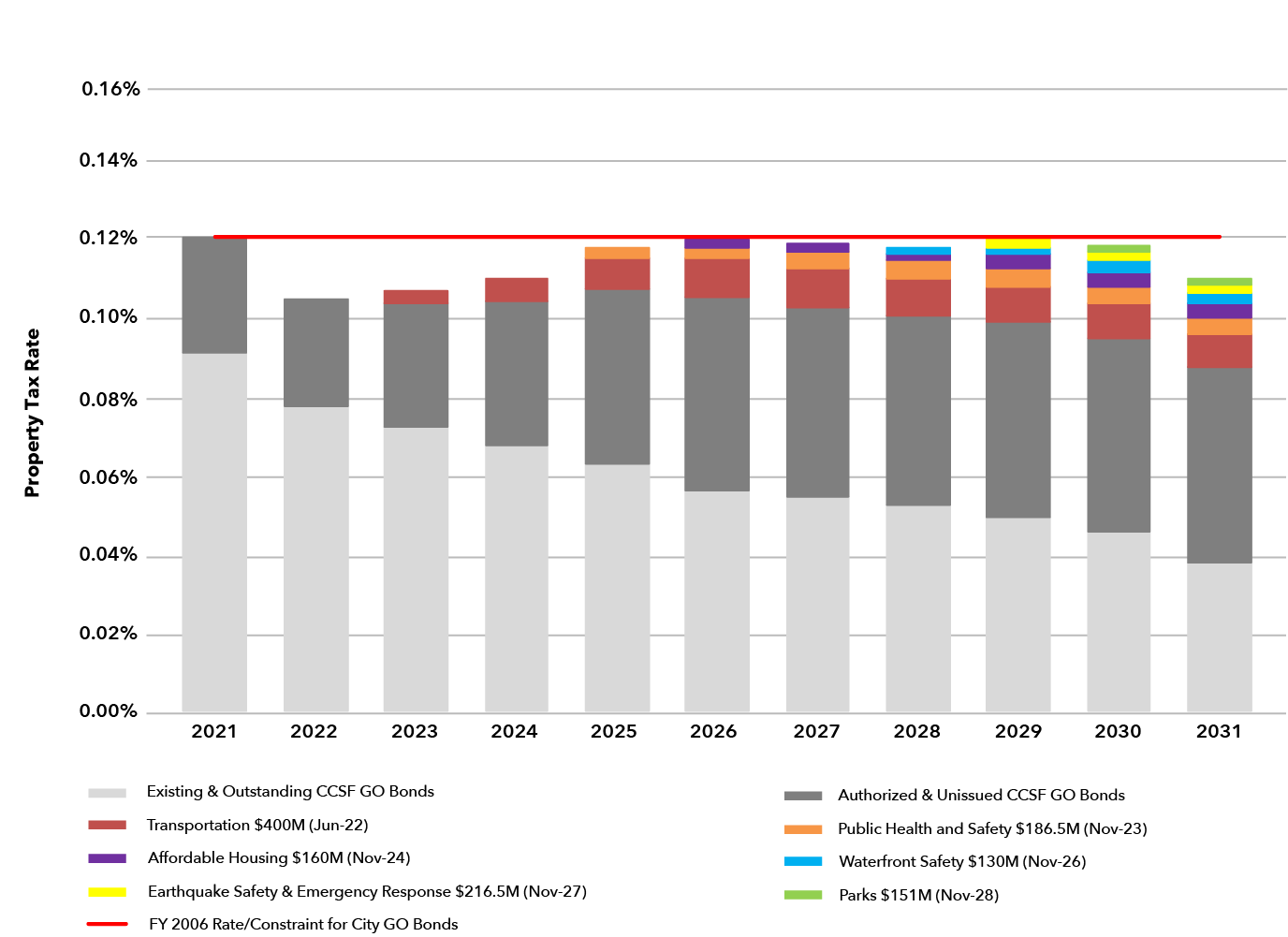

Chart 1.1 illustrates the relationship between the G.O. Bond Program and the local property tax rate, including existing and outstanding issuance and voter-approved Bonds. This view shows the City’s policy constraint that G.O. Bonds will not increase the property tax rate above 2006 levels.

All future debt program amounts are estimates and may be adjusted.

Table 1.5

| G.O. Bond Program | ||

| (Dollars in Millions) | ||

| Election Date | Bond Program | Amount |

| Jun-22 | Transportation | 400 |

| Nov-23 | Public Health | 188 |

| Nov-24 | Affordable Housing | 160 |

| Nov-26 | Waterfront Safety | 130 |

| Nov-27 | Earthquake Safety & Emergency Response | 217 |

| Nov-28 | Parks and Open Space | 151 |

| Nov-31 | Public Health | TBD |

| Total | 1,245 | |

Chart 1.1

Certificates of Participation

The Plan anticipates $765 million in Certificates of Participation (COPs), also known as General Fund debt, over the next 10 years. COPs are backed by a physical asset in the City’s capital portfolio and repayments are appropriated each year out of the General Fund. While the overall COP program is $200 million lower than the previous Plan, it makes significant commitments in the early years to address reductions in the Pay-Go program and support projects to promote economic stimulus and racial equity.

Table 1.6 shows the Capital Plan’s COP Program for the next 10 years.

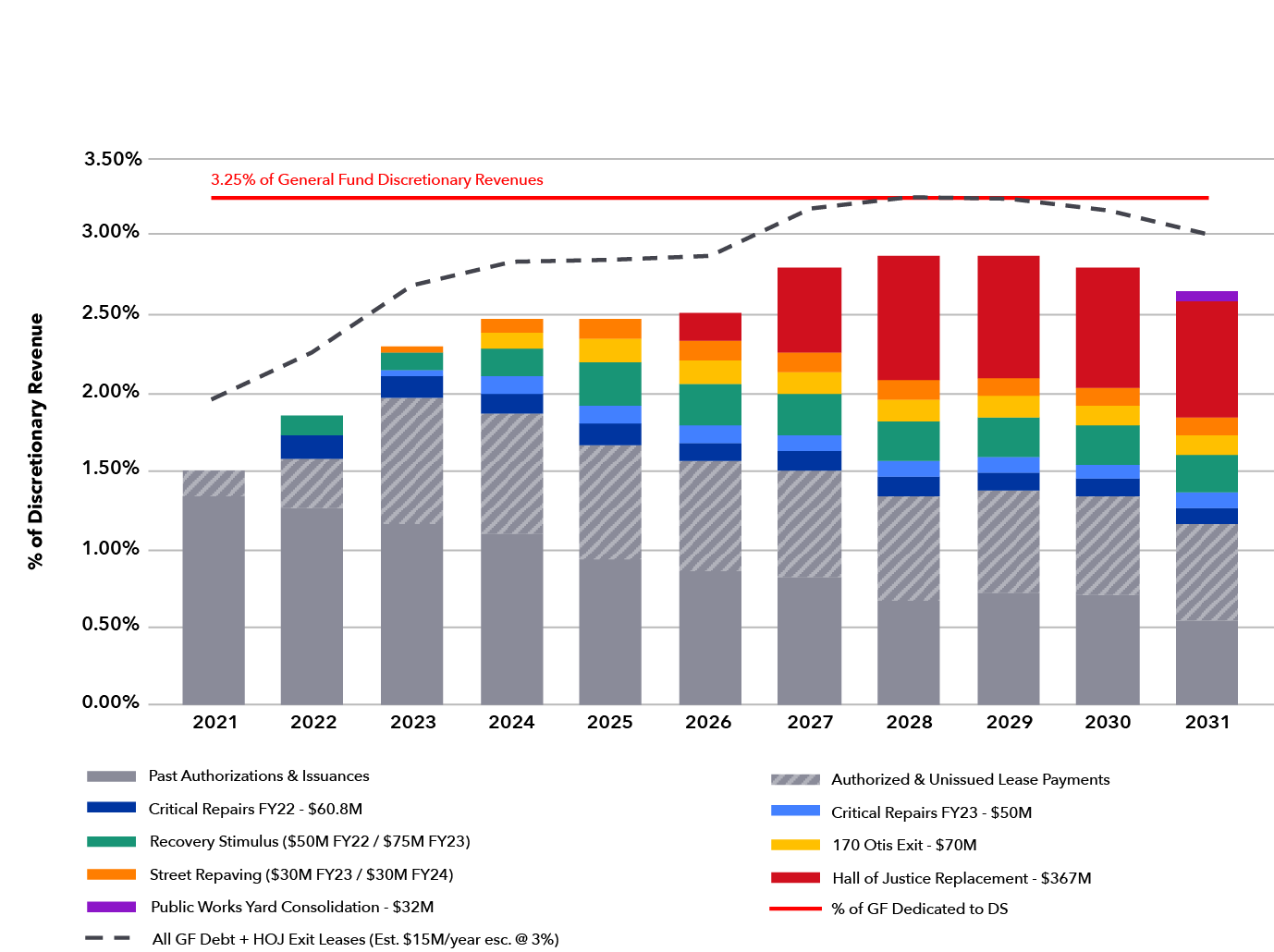

Chart 1.2 illustrates the COP program against the City’s policy constraint for General Fund debt not to exceed 3.25% of General Fund Discretionary Revenue.

All amounts attributed to future debt programs are estimates and may need to be adjusted.

Table 1.6

| COP Program | ||

| (Dollars in Millions) | ||

| Fiscal Year of Issuance | Project | Amount |

| FY2022 | Critical Repairs | 61 |

| FY2022 | Recovery Stimulus | 50 |

| FY2023 | Relocation of HSA Headquarters | 70 |

| FY2023 | Critical Repairs | 50 |

| FY2023 | Recovery Stimulus | 75 |

| FY2023 | Street Resurfacing | 30 |

| FY2024 | Street Resurfacing | 30 |

| FY2025 | HOJ Consolidation Project | 367 |

| FY2031 | Public Works Yard Consolidation | 32 |

| Total | 765 | |

Chart 1.2