The Plan anticipates $2 billion in General Obligation (G.O.) Bonds over the next 10 years. G.O. Bonds are backed by the City’s property tax revenue and are repaid directly out of property taxes through a fund held by the Treasurer’s Office. As a result of the successful passage of several large bonds in the past few years, the capacity of the G.O. Bond Program is fairly limited in the near-term.

Table 1.5 shows the Capital Plan’s G.O. Bond Program for the next 10 years.

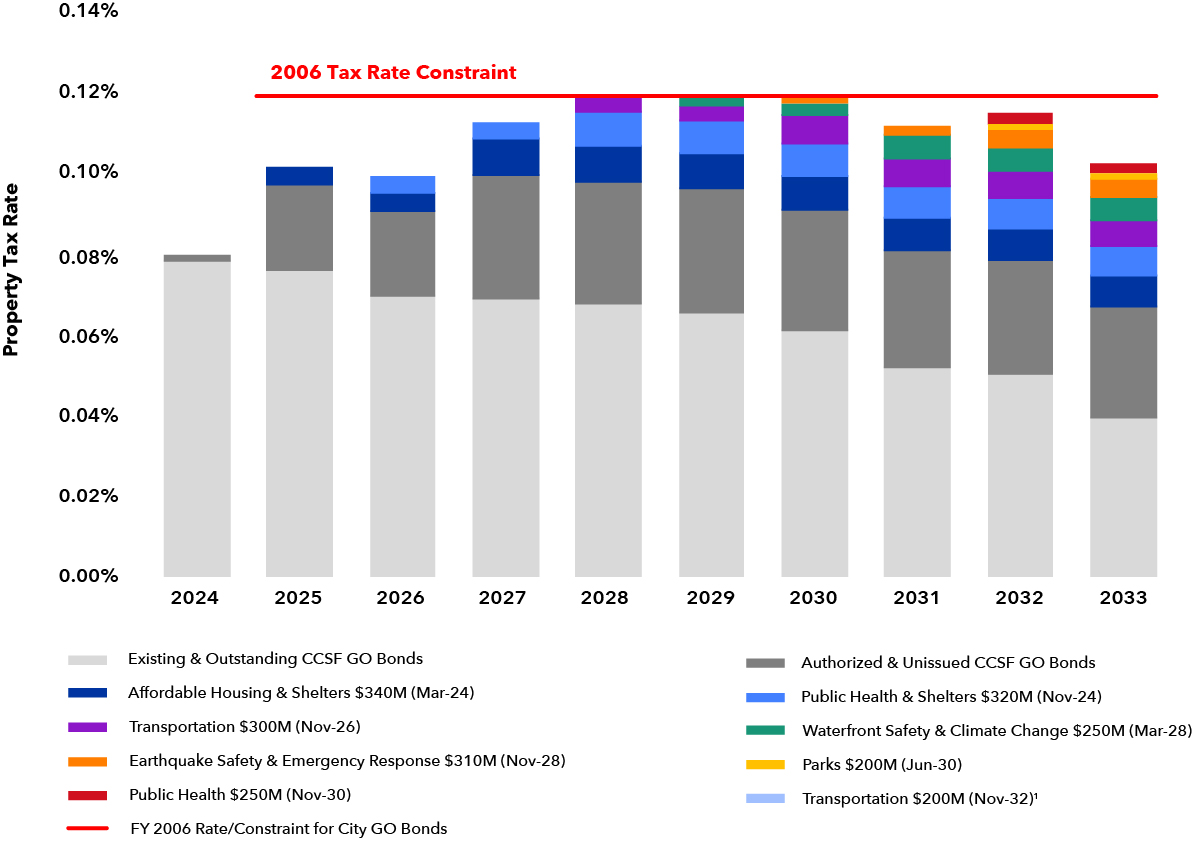

Chart 1.1 illustrates the relationship between the G.O. Bond Program and the local property tax rate, including existing and outstanding issuance and voter-approved Bonds. This view shows the City’s policy constraint that G.O. Bonds will not increase the property tax rate above 2006 levels.

All amounts attributed to future debt programs are estimates and may need to be adjusted.

Table 1.5

|

G.O. Bond Debt Program (Dollars in Millions) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

|

Election Date |

Bond Program |

Amount |

|||||||

|

Mar 2024 |

Affordable Housing & Shelters |

340 |

|||||||

|

Nov 2024 |

Public Health & Shelters |

320 |

|||||||

|

Nov 2026 |

Transportation |

300 |

|||||||

|

Mar 2028 |

Waterfront and Climate Safety |

250 |

|||||||

|

Nov 2028 |

Earthquake Safety & Emergency Response |

310 |

|||||||

|

Jun 2030 |

Parks and Open Space |

200 |

|||||||

|

Nov 2030 |

Public Health |

250 |

|||||||

|

Nov 2032 |

Transportation |

200 |

|||||||

|

Total |

|

2,170 |

|||||||

Chart 1.1