Many of San Francisco's capital improvements are funded with voter-approved General Obligation Bonds (G.O. Bonds), General Fund debt called Certificates of Participation (COPs), or revenue bonds.

Issuing debt is a typical method for financing capital enhancements with long useful lives and high upfront costs, which the City would not be able to cover through the Pay-Go Program. The use of debt also spreads the financial burden of paying for facilities between current residents and future generations who will also benefit from the projects.

For planning purposes department-level allocations have been assigned in this document for planned G.O. Bond and COP programs. These allocations are subject to change and will be refined prior to approval from the Capital Planning Committee based on information from Citywide needs assessments such as the HAZUS analysis and from evolving

departmental priorities.

General Obligation Bonds

G.O. Bonds are backed by the City’s property tax revenue and are repaid directly out of property taxes through a fund held by the Treasurer’s Office.

The Plan structures the G.O. Bond schedule around the notion of rotating bond programs across areas of capital need, although the City’s debt capacity, election schedules, and capital needs also inform these levels. This approach was established in the original Capital Plan and has been maintained ever since.

Priority areas of need for capital improvements include Earthquake Safety & Emergency Response, Parks & Open Space, Transportation, and Public Health; however, the Plan occasionally recommends bonds outside these categories if there is a demonstrated capital need that the City would otherwise not be able to afford. Table 5.1 lays out the planned G.O. Bond schedule for upcoming elections.

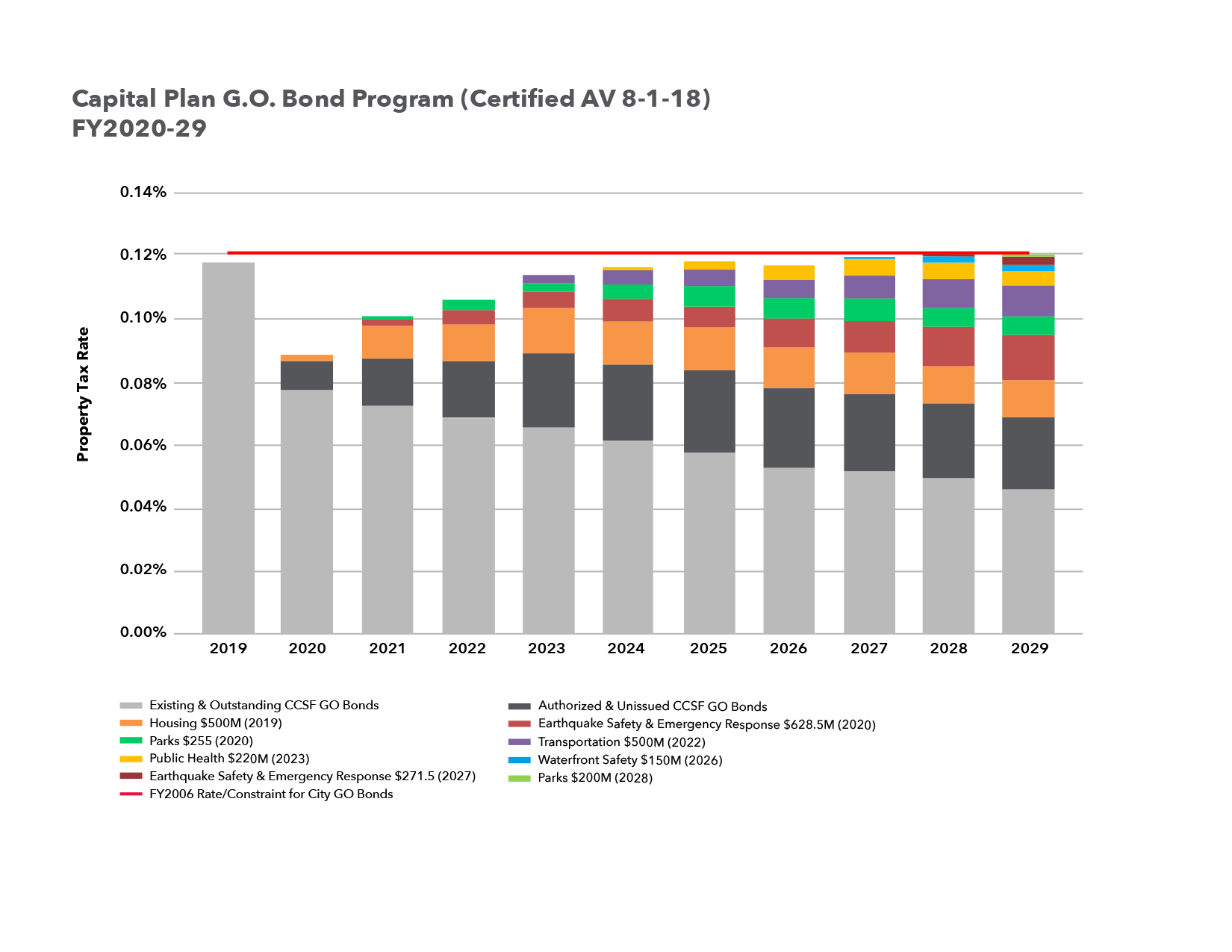

Chart 5.1 illustrates the impact on the local tax rate of issued, expected, and planned G.O. Bond debt. The red line represents the property tax limit policy established in 2006 that sets the annual level of bond debt repayment. The space between the red line and the bars on the chart illustrates the projected capacity for bond debt for each year. This capacity is largely driven by changes in assessed value and associated property tax revenues within the City. The recent economic boom has increased assessed value growth over the past several years, but there is an expectation that this will level off when the economy turns.

Table 5.1

|

G.O. Bond Program (Dollars in Millions) |

||

|---|---|---|

|

Election Date |

Bond Program |

Proposed Amount |

|

November 2019 |

Affordable Housing |

500 |

|

March 2020 |

Earthquake Safety & Emergency Response |

628.5 |

|

November 2020 |

Parks & Open Space |

255 |

|

June 2022 |

Transportation |

500 |

|

November 2023 |

Public Health |

220 |

|

November 2026 |

Waterfront Safety |

150 |

|

November 2027 |

Earthquake Safety & Emergency Response |

271.5 |

| November 2028 | Parks & Open Space | 200 |

|

Total |

|

2,725 |

Chart 5.1

Certificates of Participation

Certificates of Participation (COPs) are backed by a physical asset in the City’s capital portfolio, and repayments are appropriated each year repaid from the City’s General Fund or revenue that would otherwise flow to the General Fund. The City utilizes COPs to leverage the General Fund to finance capital projects and acquisitions.

Funding from COPs is planned to support critical City responsibilities such as relocating City staff from seismically deficient buildings and modernizing the Public Works Operations Yard.

Table 5.2 shows the Capital Plan’s COP Program for the next ten years. This Program also includes two years of $60 million each for critical repairs in a recession or economic slowdown, which reserves capacity for capital needs in the event of a downturn and associated impact to the Pay-Go Program.

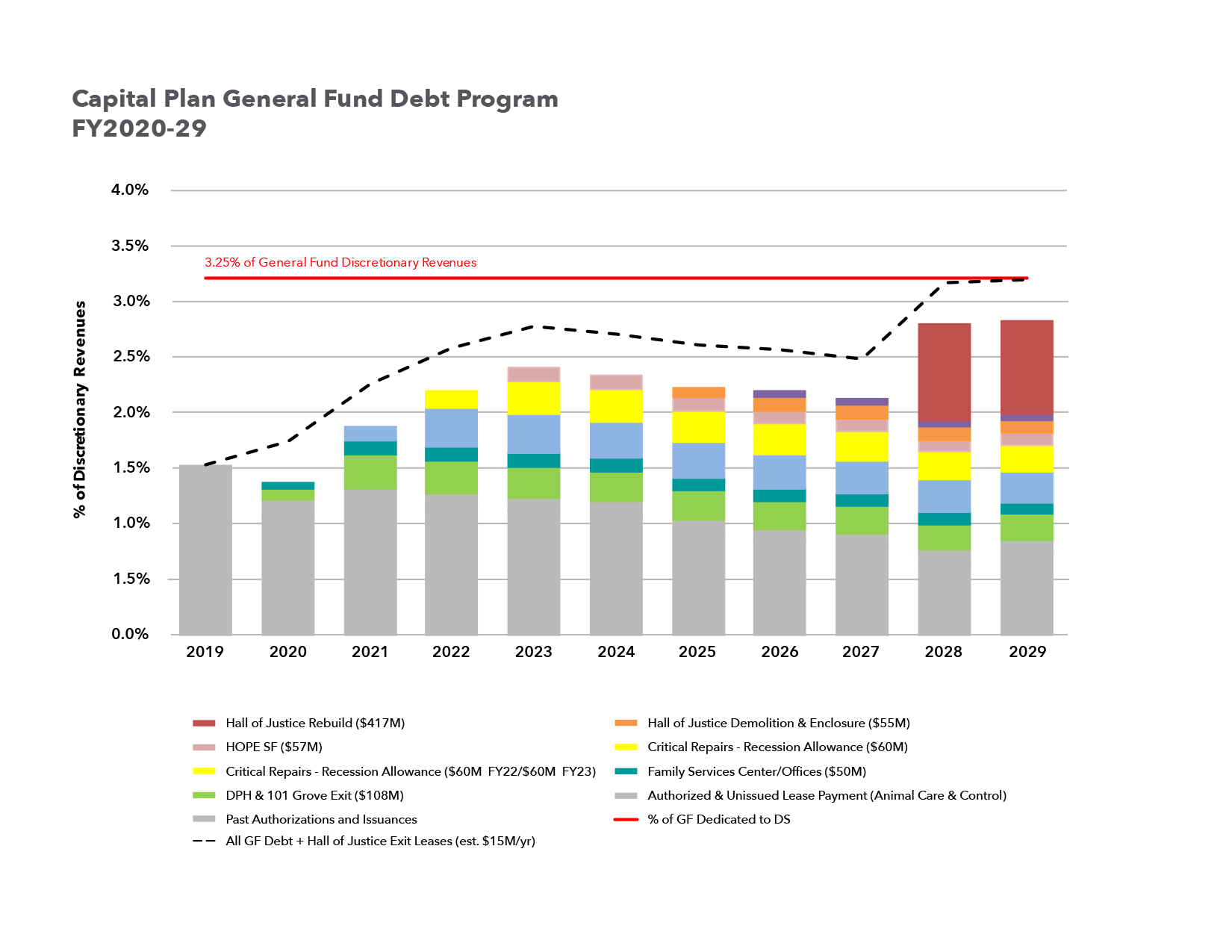

Chart 5.2 shows the planned COP Program against the policy constraint for General Fund debt not to exceed 3.25% of General Fund Discretionary Revenue, represented by the red horizontal line. The black line depicts the annual lease costs related to the Hall of Justice Administrative Exit efforts approved in 2018, which are also counted against this Program’s constraint.

The bottom portions of the columns represent debt service commitments for previously issued and authorized but unissued COPs, including the debt issued for the Moscone Center, the War Memorial Veterans Building, and the Animal Care & Control Shelter replacement. New obligations are represented in discrete colors, beginning in FY2020. As with the G.O. Bond Program, all amounts attributed to future COP-funded programs are estimates and may need to be adjusted in future plans to account for new federal and state laws, programmatic changes, site acquisition, alternate delivery methods, changing rates of construction cost escalation, and/or newly emerged City needs.

Table 5.2

|

COP Program (Dollars in Millions) |

||

|---|---|---|

|

Fiscal Year of Issuance |

Project |

Amount |

| FY2019 |

Public Health 101 Grove Exit |

108 |

|

FY2019 |

HOPE SF Horizontal Infrastructure |

57 |

|

FY2020 |

Family Services Center/City Offices |

50 |

|

FY2020 |

Hall of Justice Relocation Projects |

131 |

|

FY2022 |

Critical Repairs Recession Allowance |

60 |

|

FY2023 |

Critical Repairs Recession Allowance |

60 |

|

FY2025 |

Hall of Justice Demolition & Enclosure |

55 |

|

FY2026 |

Public Works Yards Consolidation |

25 |

| FY2028 | Hall of Justice Consolidation Plan | 417 |

|

Total |

963 |

|

Chart 5.2

Revenue Bonds

Revenue bonds are a type of debt that is repaid from revenues generated by projects that the debt was used to finance. Revenue bonds are typically used by the City’s enterprise departments (SFMTA, Port, SFPUC, and SFO), which generate their own revenues from fees paid by users of services provided by those agencies. This type of debt is repaid solely by users of those projects and therefore does not require payments from the General Fund. Examples of projects funded by revenue bonds are the SFPUC’s Water Systems Improvement Program or the Airport’s Terminal Renovation Program.

Table 5.3 shows the currently planned amount of revenue bonds to be issued over the 10-year term of this Plan. All revenue bond issuances are subject to change based on market conditions and cash flow needs of the associated projects.

Table 5.3

|

Planned Revenue Bond Issuances FY2020-29 (Dollars in Millions) |

|||

|---|---|---|---|

|

Agency |

FY20-24 |

FY25-29 |

Total |

|

SFPUC |

3,882.1 |

976.2 |

4,858.3 |

|

Airport |

2,882.9 |

0.0 |

2,882.9 |

|

SFMTA |

0.1 |

0.0 |

0.1 |

|

Total |

6,765.1 |

976.2 |

7,741.3 |