2024 - Affordable Housing: Sources for Publicly Supported Affordable Housing

OCII Hunters Point Shipyard Phase 1 Block 57 Landing, Photo Credit: Innes Ken

San Francisco is fortunate to count on a number of capital sources of funding to provide as subsidy to support the production of affordable housing.

General Fund

The Housing Trust Fund: Established in 2012 through the passage of Proposition C, the Housing Trust Fund is an annual set-aside in the General Fund. The Housing Trust Fund is a 30-year fund capped at $50 million per year, representing a total of $1.2 billion in funding for housing subsidies over the life of the fund.

Local Operating Support Program (LOSP): Local Operating Support Program (LOSP): These subsidies provide ongoing operating support to permanent supportive housing through 15-year contracts with affordable housing owners. LOSP subsidies cover the difference between tenant-paid rent (very low for formerly homeless households) and the operating cost of the units.

One-Time General Fund Appropriations: When San Francisco receives one-time sources, one-time capital uses such as affordable housing are the preferred use. San Francisco has committed one half of excess property tax revenues received through the Education Revenue Augmentation Fund (ERAF) to affordable housing.

Fees

Inclusionary and Jobs/Housing Linkage Fees: Jobs Housing Linkage Fees apply to development projects that increase the amount of commercial uses by 25,000 or more gross square feet. The 2019 Jobs Housing Linkage Fee for office development was set at $19.96 per square foot and will increase to $69.60 per square foot, and the Inclusionary Housing Program Fees are $199.50 per applicable square foot according to the most recently available local fee schedule.

Area Plan Fees: Area Plan Fees are development impact fees in the areas of San Francisco’s most concentrated growth: Eastern Neighborhoods, Market & Octavia, Visitaction Valley, Balboa Park, Rincon Hill, Transit Center, and most recently, Central SoMa. These fees are paid by developers for infrastructure needs to meet growth-driven demand, including affordable housing.

Debt

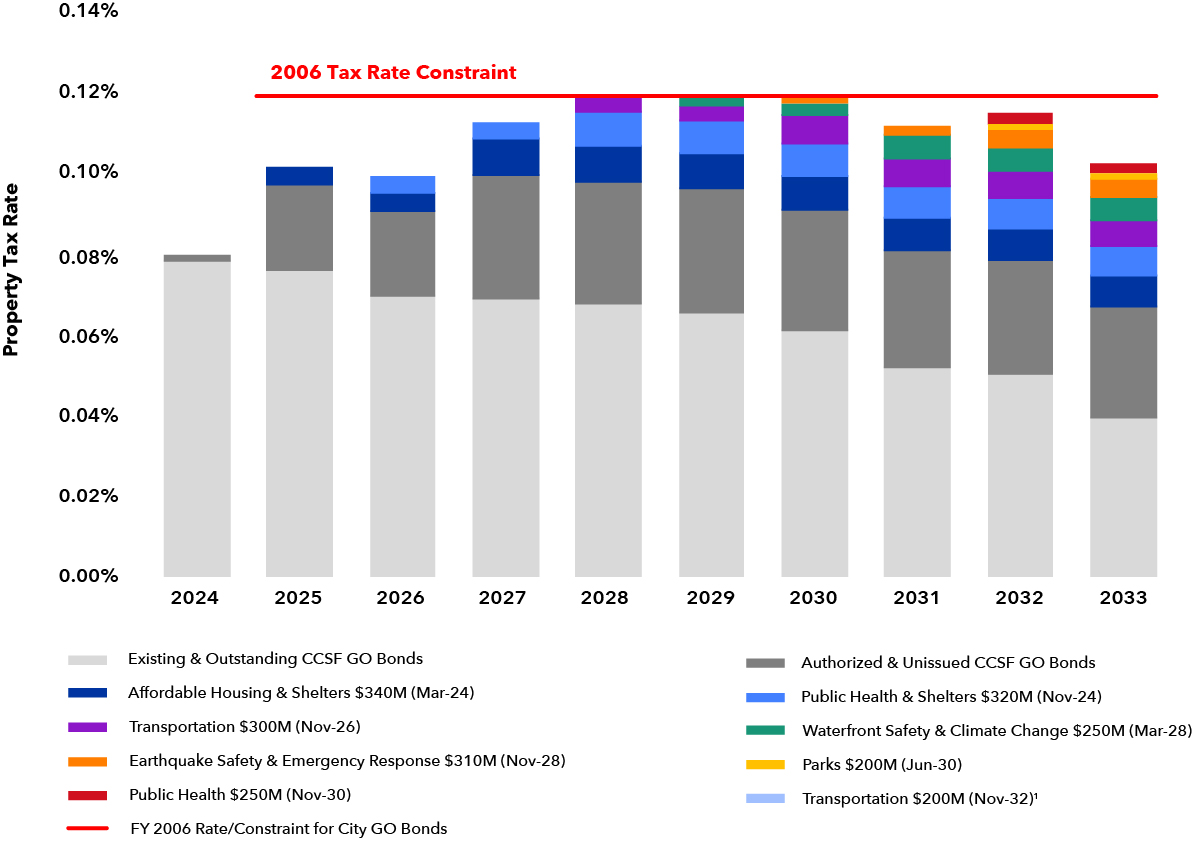

G.O. Bonds: In 2015 and 2019 San Francisco voters supported a $310 million and a $600 million G.O. bonds to support affordable housing. In 2020, voters approved the Health and Recovery G.O. Bond, including $147 million for permanent supportive housing. An affordable housing bond is planned for 2024, pending voter approval. Funds from the planned 2024 Affordable Housing G.O. bond, pending voter approval, would be directed to projects serving families, single adults, former public housing residents, and seniors.

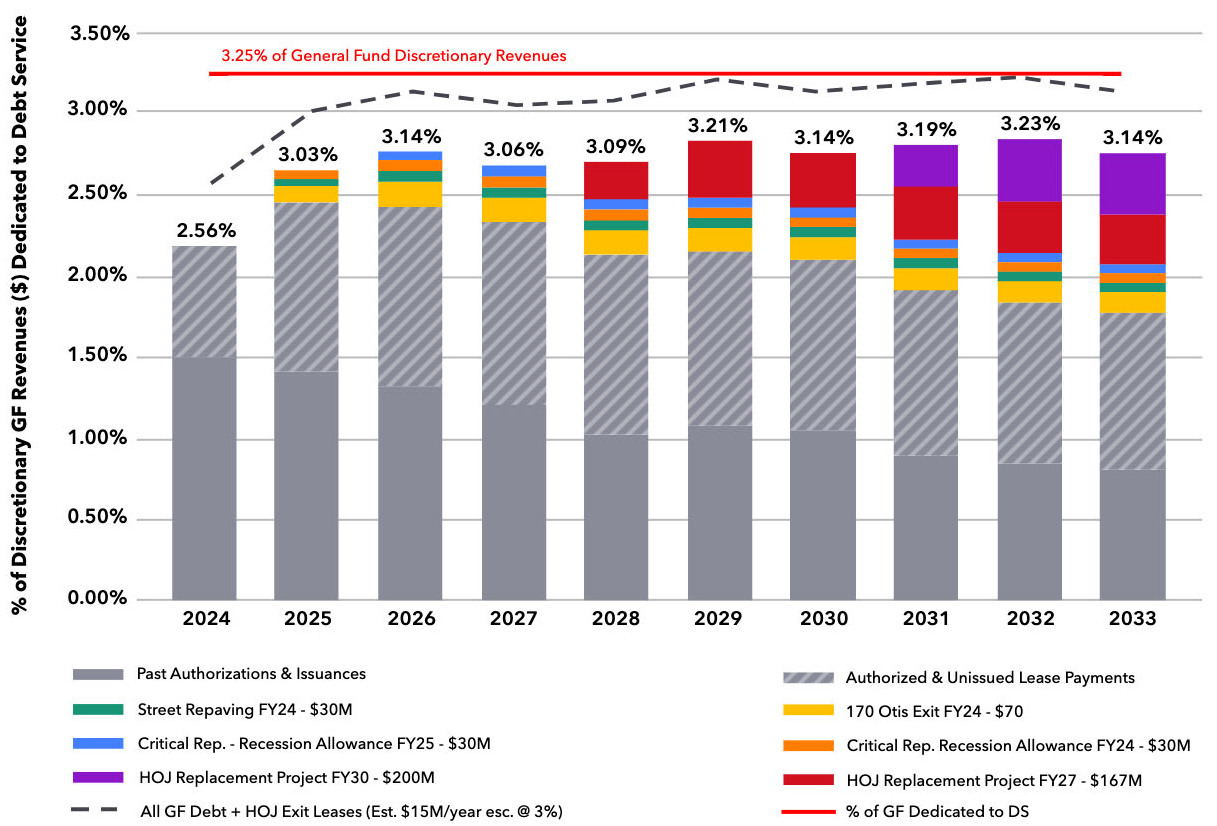

Certificates of Participation (COPs): COPs are a General Fund debt instrument is used to support public infrastructure needs and new construction at HOPE SF sites. As a part of the FY2023 budget, the Board of Supervisors approved $112 million in General Fund debt to finance five different housing and community development programs: site acquisition ($40 million), community facilities ($30 million), elevator upgrades ($10 million), educator housing ($12 million), and repairs to public housing cooperatives ($20 million). The MOHCD, the Controller’s Office of Public Finance, and the Department of Homelessness and Supportive Housing are coordinating procurement, award, and timelines for these five programs in preparation for several bond issuances starting in 2023.

PASS Program: MOHCD manages one amortizing debt product called Preservation and Seismic Safety (PASS) Program that provides below-market rate debt to acquisition/preservation projects, thereby reducing the need for direct capital subsidy.

Tax Increment Financing: Tax Increment Financing (TIF) was historically the largest source of local financing for the San Francisco Redevelopment Agency. When California dissolved redevelopment agencies in 2012, this source of funding was discontinued for local governments. As the successor agency to the Redevelopment Agency, OCII can still make use of this source to meet its affordable housing production obligations.

Federal Funds: Federal funds come to San Francisco through formula grant programs, including HOME Investment Partnerships Program (HOME) funds (for new production) and Community Development Block Grant (CDBG) (for acquisition and preservation). Although the availability of federal funding has decreased over the years, HOME and CDBG continue to play a role in San Francisco’s housing production and preservation.

Leveraged Funds: For every dollar of City funding that is provided to produce affordable housing, additional funding from the project sponsor makes the project whole. These complementary funds may include federal or state tax credits, competitive state funding, or federal rent subsidies (Section 8, Section 202/811).

Market Rate Production: Although market rate residential production is often pitted against affordable housing, whether due to competition for land or concerns over gentrification, market rate production plays an important role in the City’s overall affordability. Market rate production reduces the competition for existing housing units by higher-income households who can afford new construction. Providing housing at market-rate satisfies some of the housing need, which reduces demand on existing housing. More directly, market rate production generates affordable units through inclusionary requirements and fees. Market rate residential developers must provide a portion of the units as below market rate (BMR) units, or they may opt to (a) pay an “in lieu” fee to be used by MOHCD to fund new production; (b) build affordable units on a separate site; or (c) dedicate land to the City for production of new affordable housing.