Commonly used terms throughout the Plan are defined below.

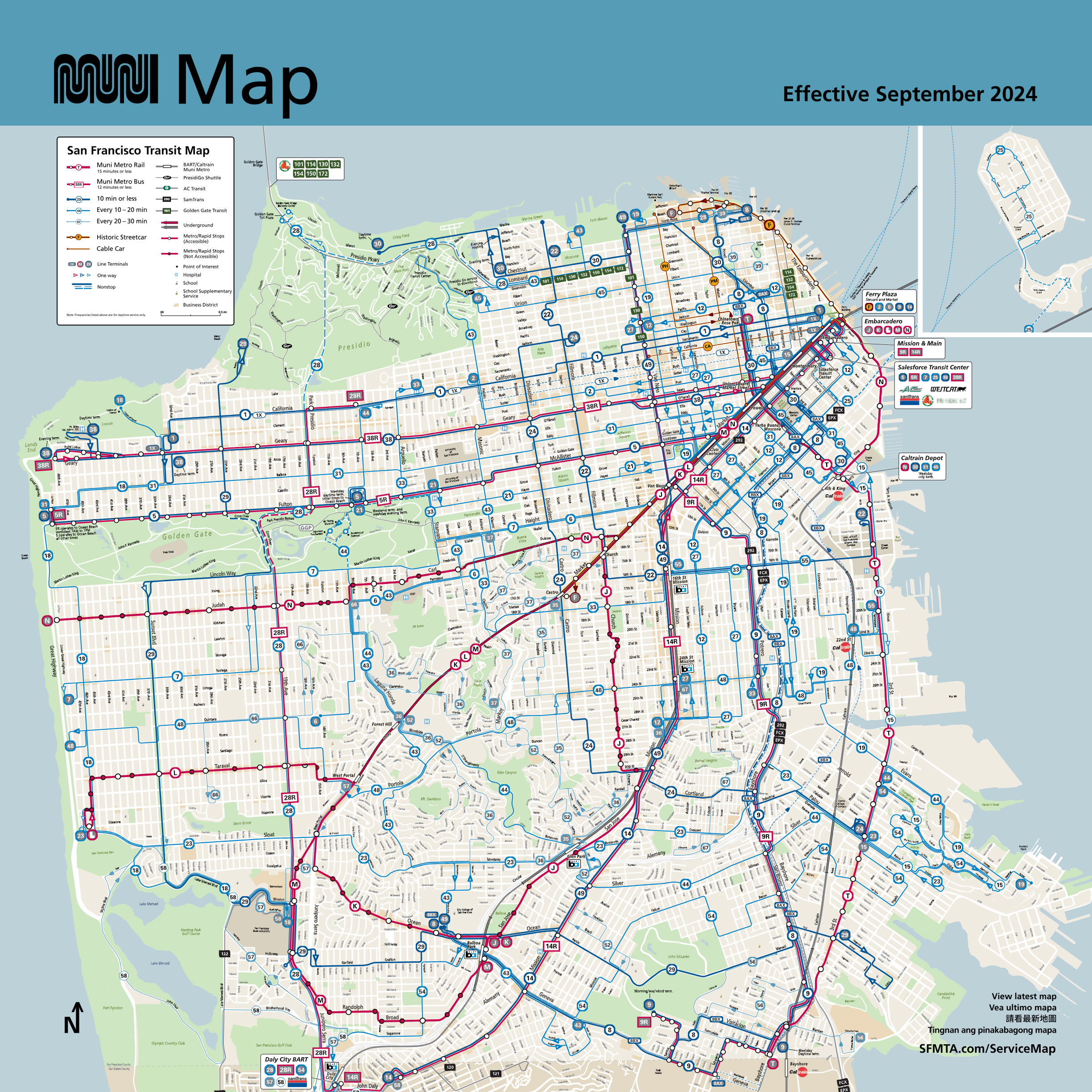

Area Plans: Subsections of the City’s General Plan that address the specific urban design, open space, transportation, housing, and community facility goals of a particular neighborhood. For the purposes of the Capital Plan, Area Plans refer to those Areas of high marginal growth governed by Chapter 36 of the San Francisco Administrative Code: Balboa Park, Eastern Neighborhoods, Central SoMa, Market/Octavia, Rincon Hill, Transit Center, and Visitacion Valley.

Assessed Value: The dollar value assigned to individual real estate or other property for the purpose of levying taxes.

Capital Project: A major construction and improvement project, including the planning and design phases. Examples include the resurfacing of a street and the construction of a new hospital, bridge, or community center.

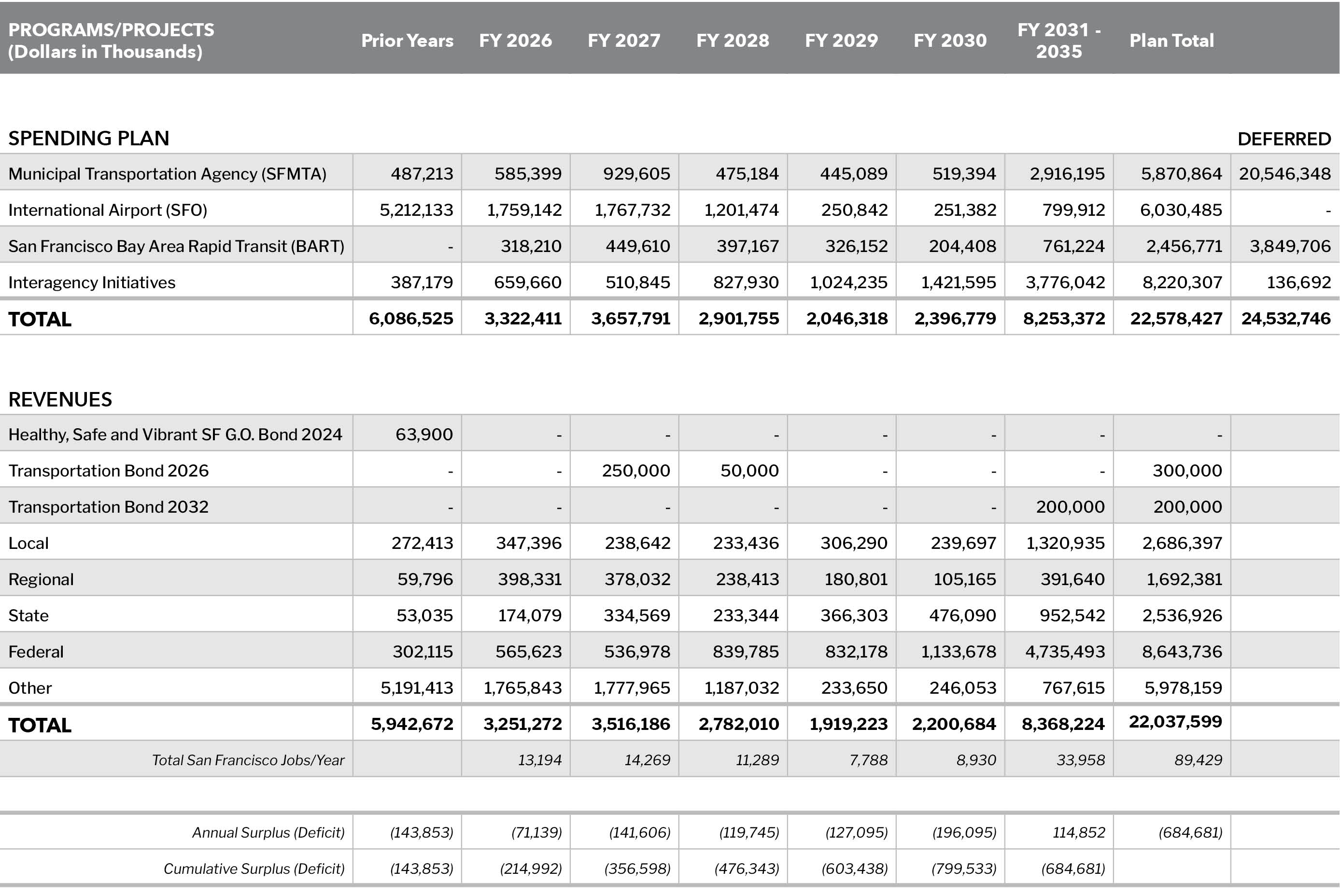

Capital Plan: Also referred to as the Plan. The City and County of San Francisco Capital Plan outlines all of the Capital Projects that are planned for the next 10 years. The City’s Capital Plan is updated every two years and has a 10-year horizon. Not every project in the plan has funding (see Deferred Project and Emerging Need), but the Plan aims to present a complete picture of the City’s strategy for maintaining and improving its infrastructure and key assets. The Capital Planning Program produces the Capital Plan based on department capital requests, and the Capital Planning Committee reviews and proposes the Plan to the Board of Supervisors.

Certificates of Participation (COPs): A commonly used form of lease financing for capital improvement projects or purchases of essential equipment. COPs are loans to the city that are paid back by the revenue generated by a building or other city-owned assets.

Community Facility District (CFD): Also known as a Mello-Roos District. A defined area such as a county, city, special district, or joint powers authority where residents vote to approve a special property taxon real estate, in addition to the normal property tax, to fund public improvements benefiting the district. The tax is often used to secure debt.

Debt Service: The annual payment of principal and interest on the City’s bonded debt (see Municipal Bond for more information on bonded debt). Debt service can be used to describe the payments for an individual project or to provide an overall picture of the city’s bonded debts.

Deferred Project: A project not funded in the Capital Plan either due to lack of funding or the timeline of the project falling outside of the 10-year planning cycle.

Emerging Need: A project not funded in the Capital Plan because additional planning is needed or there is significant uncertainty around project-specific issues. Emerging needs are included in the Plan to show the City’s awareness that they may become more significant and/or defined in coming years.

Enhancement: An investment that increases an asset’s value and/or changes its use. Enhancements typically result from the passage of new laws or mandates, functional changes, or technological advancements. Examples include purchasing or constructing a new facility or park, major renovations of or additions to an existing facility, accessibility improvements to comply with the Americans with Disabilities Act (ADA), and planting new street trees. Typically, enhancements are large-scale, multi-year, projects such as renovations, additions, or new facilities. While some project costs can be funded with pay- as-you-go sources, most enhancements require debt financing through the issuance of General Obligation bonds, Certificates of Participation, or lease revenue bonds.

Enterprise Department: An Enterprise Department generates its own revenues from fees and charges for services and thus does not rely on the General Fund. The City has four Enterprise departments: Public Utilities Commission, San Francisco International Airport, Port of San Francisco, and the Municipal Transportation Agency.

External Agency: An agency that is a separate, autonomous entity from the City and County of San Francisco and operates separately.

Facilities Maintenance:

See Routine Maintenance.

General Fund: The largest of the City’s funds, the General Fund is a source for discretionary spending and funds many of the basic municipal services such as public safety, health and human services, and public works. Primary revenue sources for the General Fund include local taxes such as property, sales, business, and others.

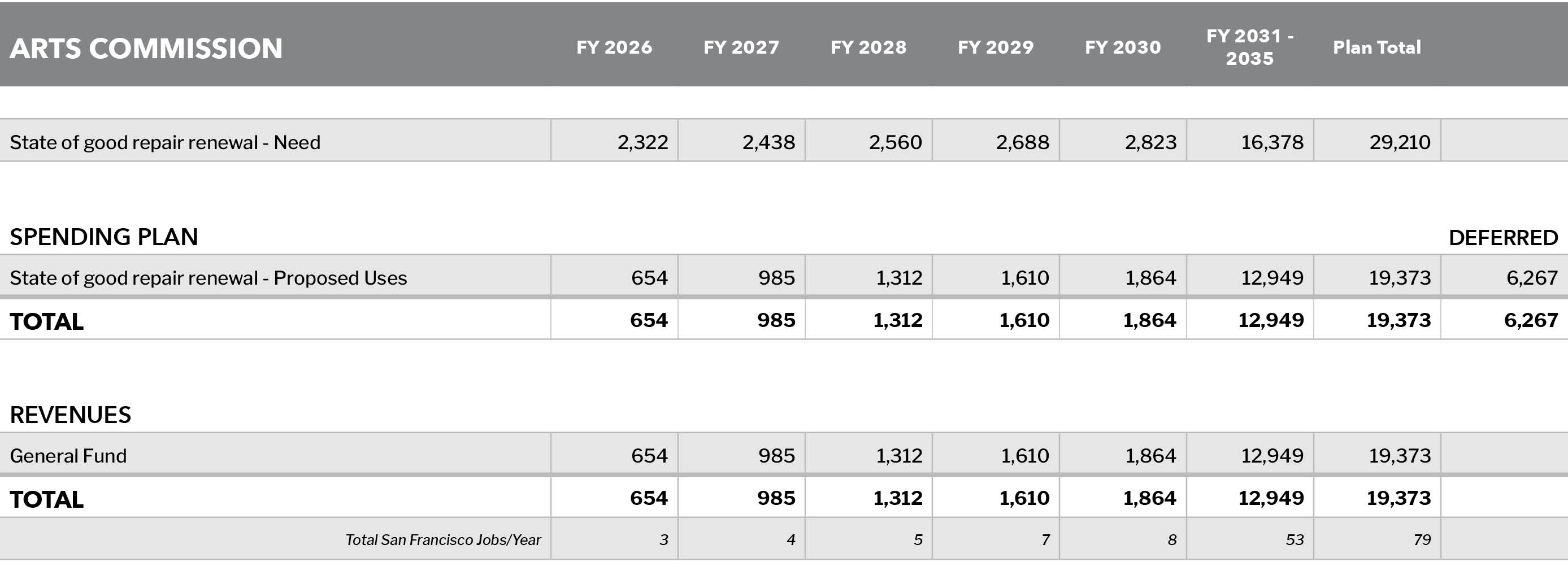

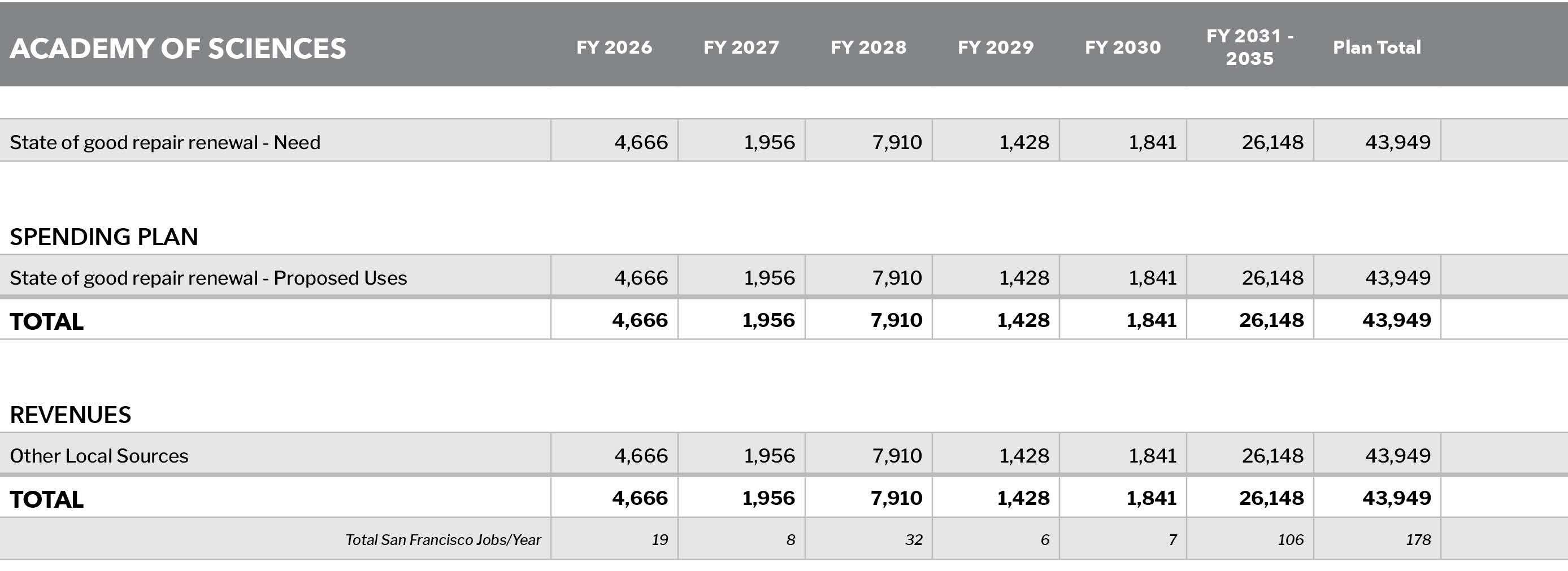

General Fund Department: A City department that relies primarily or entirely on the General Fund as a revenue source to provide City services. The General Fund departments included in the Plan are: Asian Art Museum, Arts Commission, California Academy of Sciences, District Attorney’s Office, Emergency Management, Fine Arts Museum, Fire, General Services Agency, Homelessness and Supportive Housing, Human Services Agency, Juvenile Probation, Police, Public Health, Public Library, Public Works, Recreation and Parks, Sheriff, Technology, and the War Memorial and Performing Arts Center.

General Plan: Adopted by the Planning Commission and approved by the Board of Supervisors, the General Plan is the document that serves as the foundation for all land use decisions in the City, especially around the issues of land use, circulation, housing, conservation, open space, noise and safety. It contains specific Area Plans for the planning of different City neighborhoods.

General Obligation Bonds (G.O. Bonds): A municipal bond secured by property tax revenues. G.O. Bonds are appropriately used for the construction and/or acquisition of improvements to real property broadly available to the residents and visitors of San Francisco.

Horizontal Infrastructure: Infrastructure required to deliver basic public goods and services such as roads, sewers, water lines, bridges, transit rail, and open space, among others.

Infrastructure: Physical elements of the city that allow it to function effectively for residents, workers, and visitors. This can include roads, bridges, sewers, water lines, transit rail, open space, hospitals, housing units, city offices, jails, and other public assets.

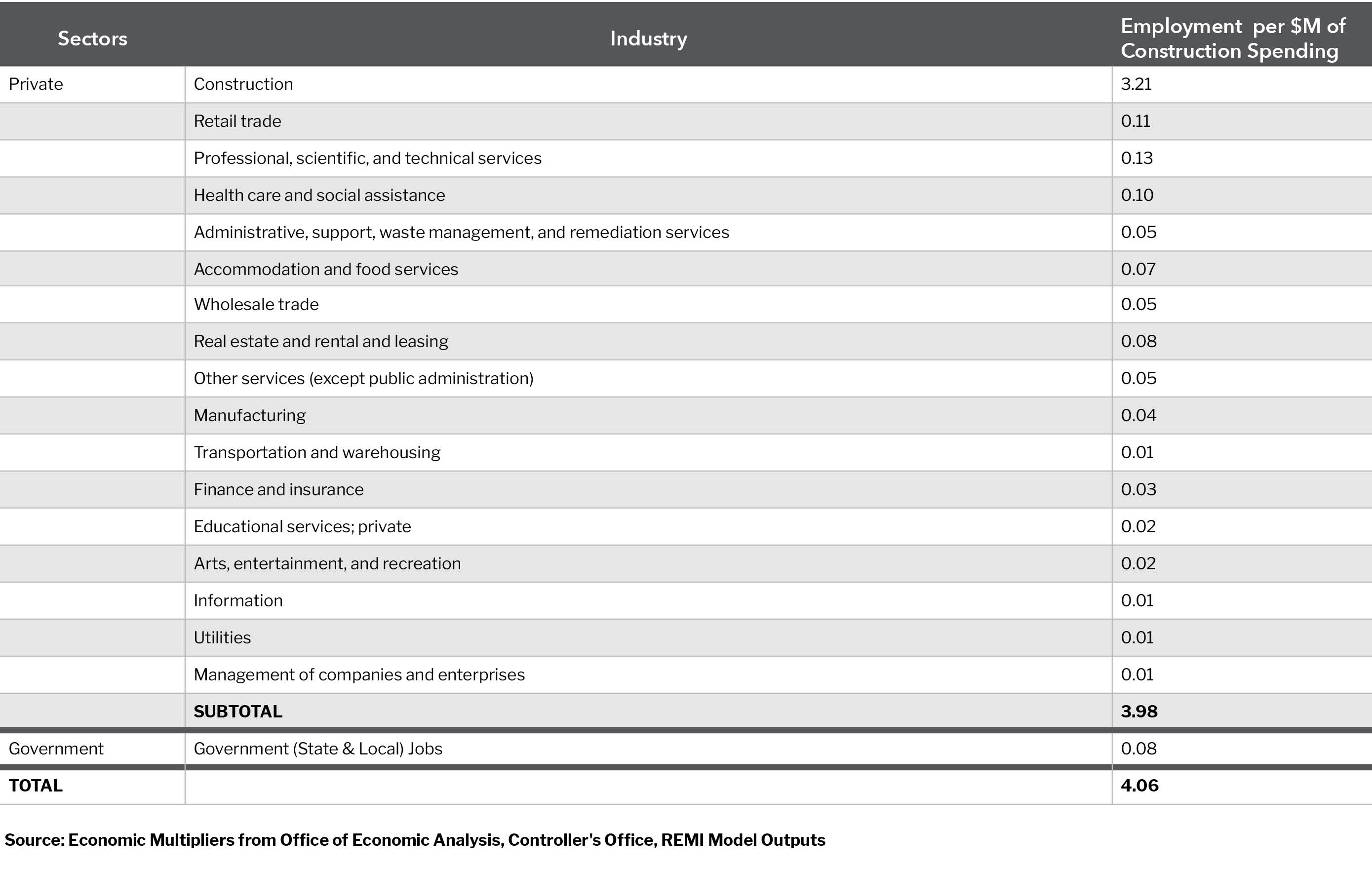

Job Years: Defined as one year of full- time work. For example, three people employed full-time for five years represent 15 job years.

Lease Financing: An important source of medium- and long-term financing where the owner of an asset gives another person the right to use that asset against periodical payments. A common example would be a landlord leasing an apartment for a monthly rent. The owner of the asset is known as lessor and the user is called lessee. There are various forms of lease financing in the Plan, including Certificates of Participation.

Mello-Roos District: See Community Facility District.

Municipal Bond: A debt obligation issued by a government entity, such as the City and County of San Francisco. When an individual buys a municipal bond, they are loaning money to the issuer – the City – in exchange for a set number of interest payments over a predetermined period. At the end of that period, the bond reaches its maturity date, and the full amount of the original investment is returned to the individual. The amount of money that the City owes as a result of selling municipal bonds is known as the City’s bonded debt. Net Assessed Value: The total assessed value of property in San Francisco, excluding property considered exempt from tax levies, such as properties owned by religious or non- profit organizations.

Pay-As-You-Go (Pay-Go): Refers to the funding of Capital Projects with current General Fund revenue on an annual basis rather than paying for projects by taking on long-term debt or using another dedicated funding source.

The Plan: See Capital Plan.

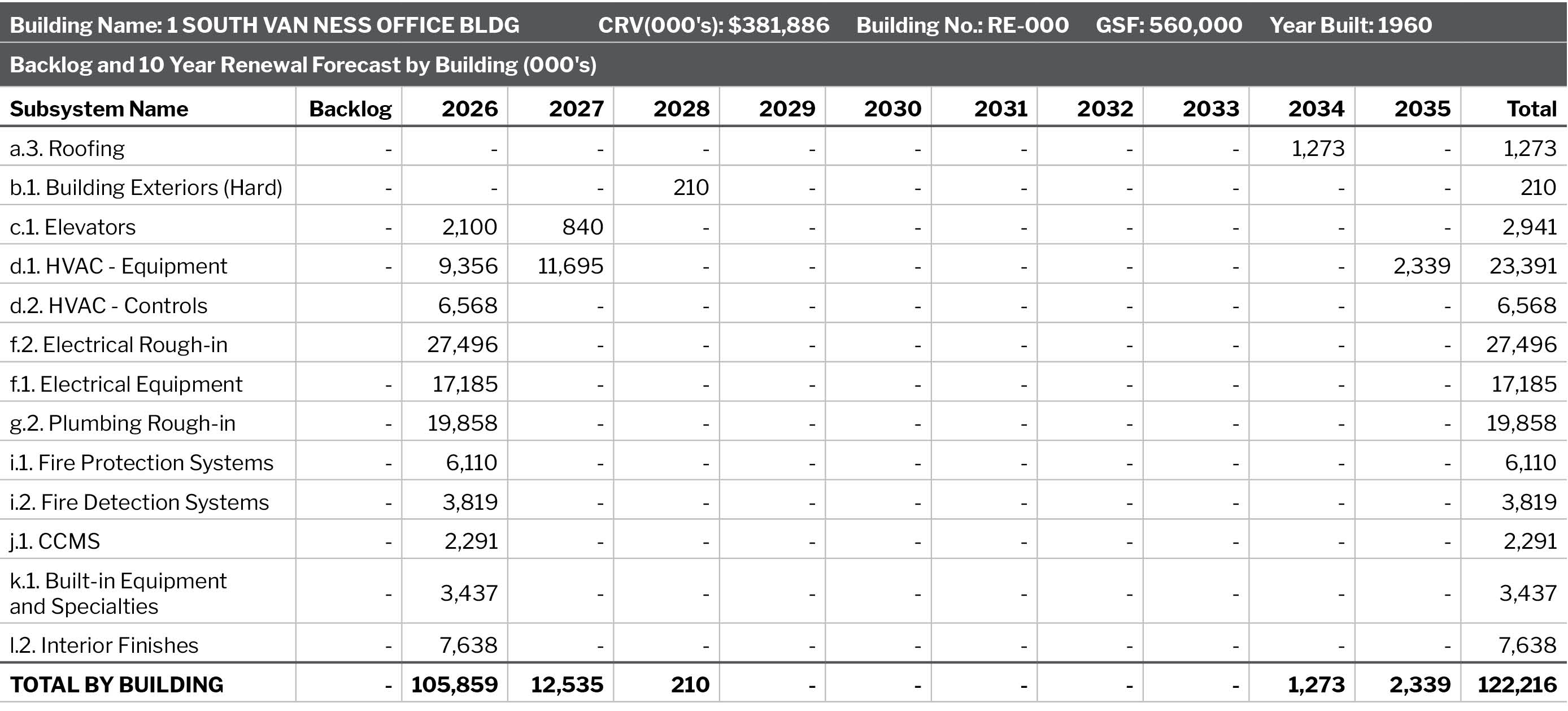

Renewal: An investment that preserves or extends the useful life of facilities or infrastructure. Examples of renewal projects include the repair and replacement of major building systems including the roof, exterior walls and windows, and heating and cooling systems; street resurfacing; and the repair and replacement of infrastructure in the public right-of-way, including sidewalks and street structures.

Since renewal projects tend to be smaller investments compared with investments needed to replace entire facilities, the Plan funds many of these needs through Pay-Go cash revenue sources, appropriated through the City’s annual budget process.

Revenue Bond: A municipal bond secured by and repaid from specific revenues. Pledged revenues are often earnings from a self-supporting enterprise or utility. Typically, these revenues are associated with the asset for which the bond was originally issued, for example those issued by the Airport or Public Utilities Commission.

Right-of-Way Infrastructure: Infrastructure constructed and maintained by the City for right-of-way purposes, which are defined as the right of public travel on certain lands. Examples include the traveled portion of public streets and alleys, as well as the border areas, which include, but not limited to, any sidewalks, curb ramps, planting strips, traffic circles, or medians.

Routine Maintenance: Also known as Facilities Maintenance. Projects that provide for the day-to-day maintenance of existing buildings and infrastructure, including labor costs. Unlike renewals and enhancements, these are annual allocations.

Vertical Infrastructure: Facility structures such as hospitals, clinics, public safety buildings, administrative facilities, public housing units, community centers, and jails, among others.