San Francisco has adopted numerous special financing districts to finance public infrastructure and affordable housing to benefit newly developing areas and for infill areas of the city. Projects that may be financed by these districts vary by law but can include streets, water and sewer systems, libraries, parks, public safety facilities, and affordable housing.

Authorized under the Mello-Roos Community Facilities Act of 1982 and/or the City’s Special Tax Financing Law, Community Facilities Districts and Special Tax Districts (collectively, CFDs) assess a special tax lien against taxable property within a district to fund capital projects and/or ongoing operations and maintenance costs. These districts are typically established either by a two-thirds vote of property owners or registered voters within the district and by approval of the Board of Supervisors. The following CFDs have been established: Treasure Island, Central SoMa, Pier 70 (Condo and Leased Properties), Mission Rock, Transbay (partnership with the Transbay Joint Powers Authority), Potrero Power Station, and CFDs at Hunters Point/Candlestick Point (OCII) and Mission Bay (OCII).

California State Government Code allows municipalities to fund improvements within a designated geographic boundary through the formation of infrastructure finance districts (IFDs), infrastructure revitalization and financing districts (IRFDs), and enhanced infrastructure financing districts (EIFDs) (collectively, IFDs). These districts capture future increases in property tax revenue stemming from growth in assessed value as a result of new development. In San Francisco, that incremental increase in property revenue from an IFD is typically shared between the City and the developer of the project. IFD proceeds are used to finance public capital facilities or other specified projects of communitywide significance that provide significant benefits to the district or the surrounding community.

Each district has as a unique plan of finance for the use of tax increment or special taxes, which is outlined in each district’s legislatively-approved Infrastructure Financing Plan for IFDs or Resolution of Formation for CFDs.

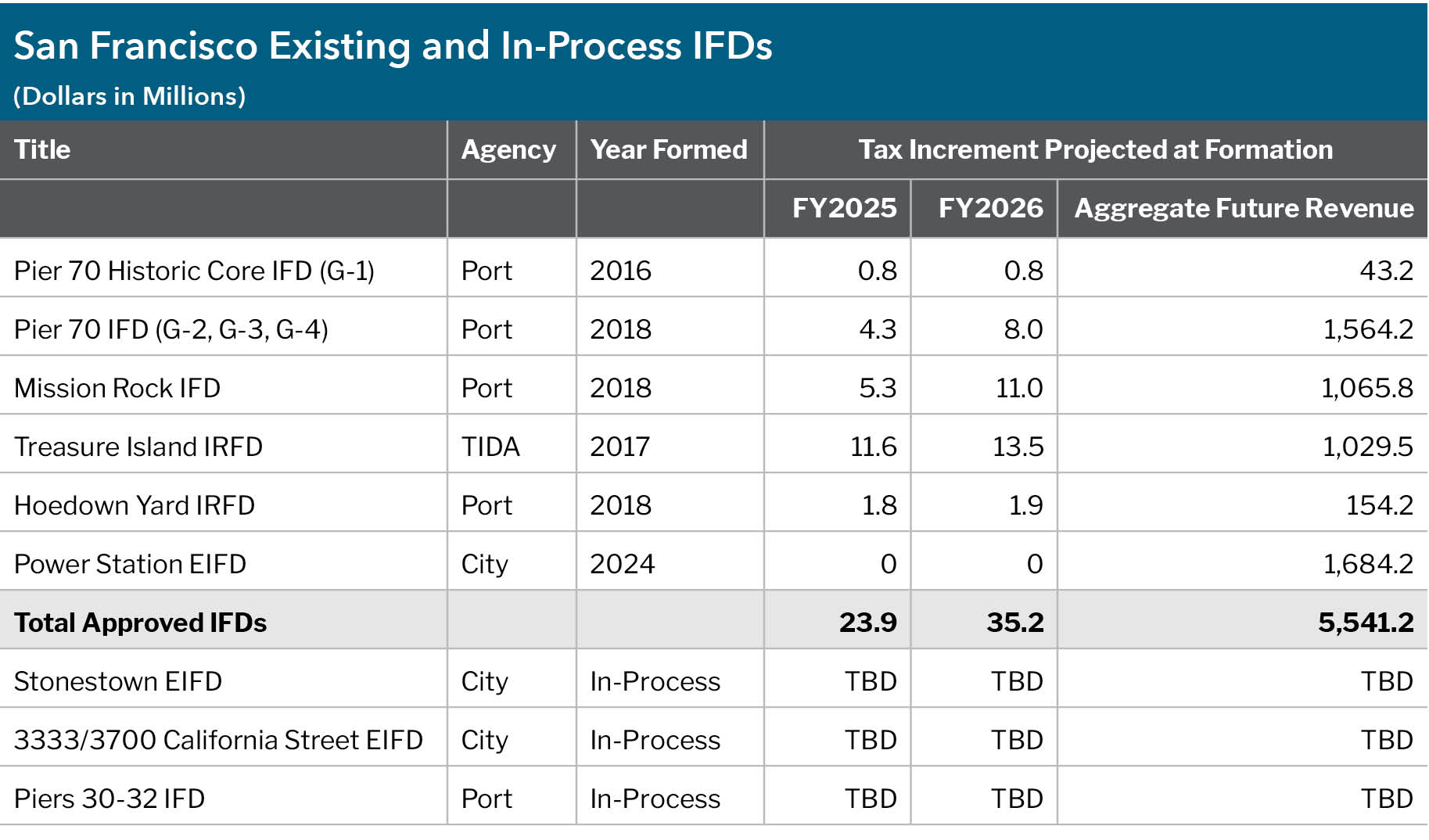

Table 5.5 provides an overview of existing and proposed IFDs in San Francisco. One of the policy constraints approved by the Capital Planning Committee and ratified by the Board of Supervisors is that total IFD debt should not exceed 5% of the City’s total annual property tax revenue. The 5% threshold is being tracked by the Controller’s Office of Public Finance. For more information on San Francisco’s policies for the establishment and use of IFDs, including the relevant fiscal constraints, please see Appendix D.

Table 5.5